Till builds smarter spenders.

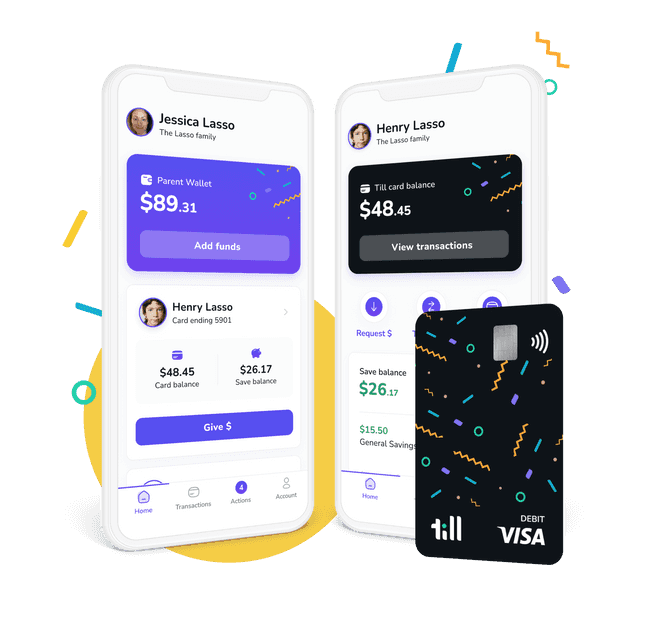

With Till’s fee-free app and debit card, kids can develop money habits that prepare them for the real world.

FEATURED ON

Banking fees are for adults.

And even that’s debatable. Our fee-free platform is designed to give kids the freedom to focus on spending savvy, not paying fees.

Scan this code with your phone’s camera to download Till.

How Till Works

It’s simple really. We help families prepare kids for the reality of money management in life: how to earn, spend, and save.

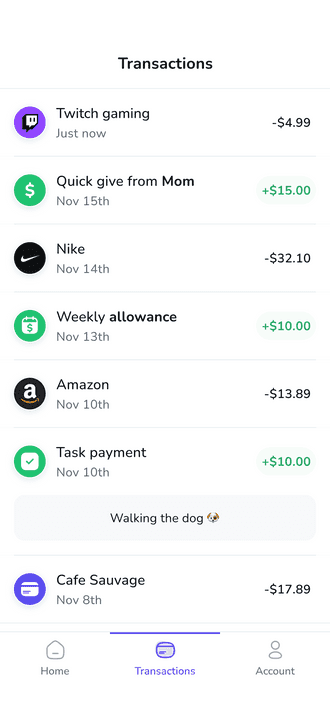

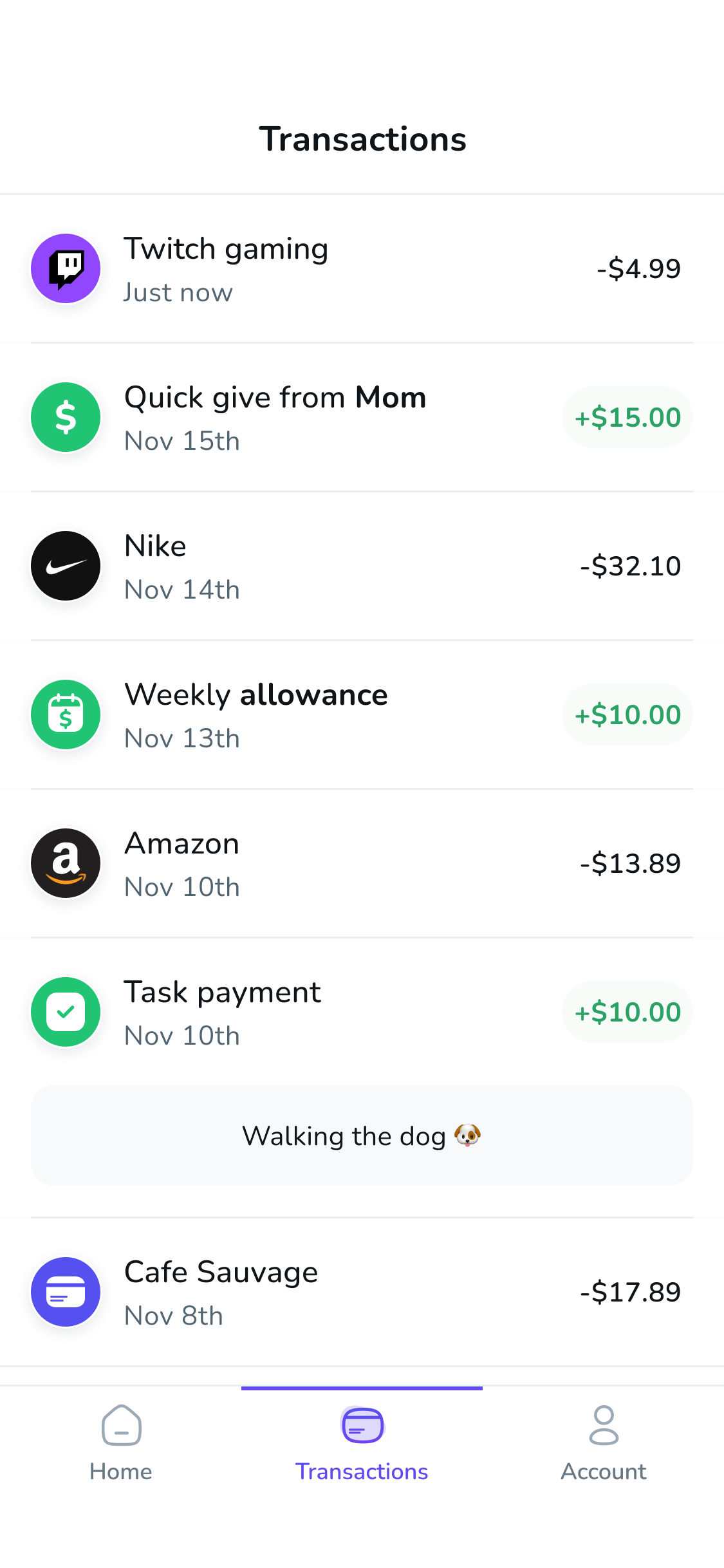

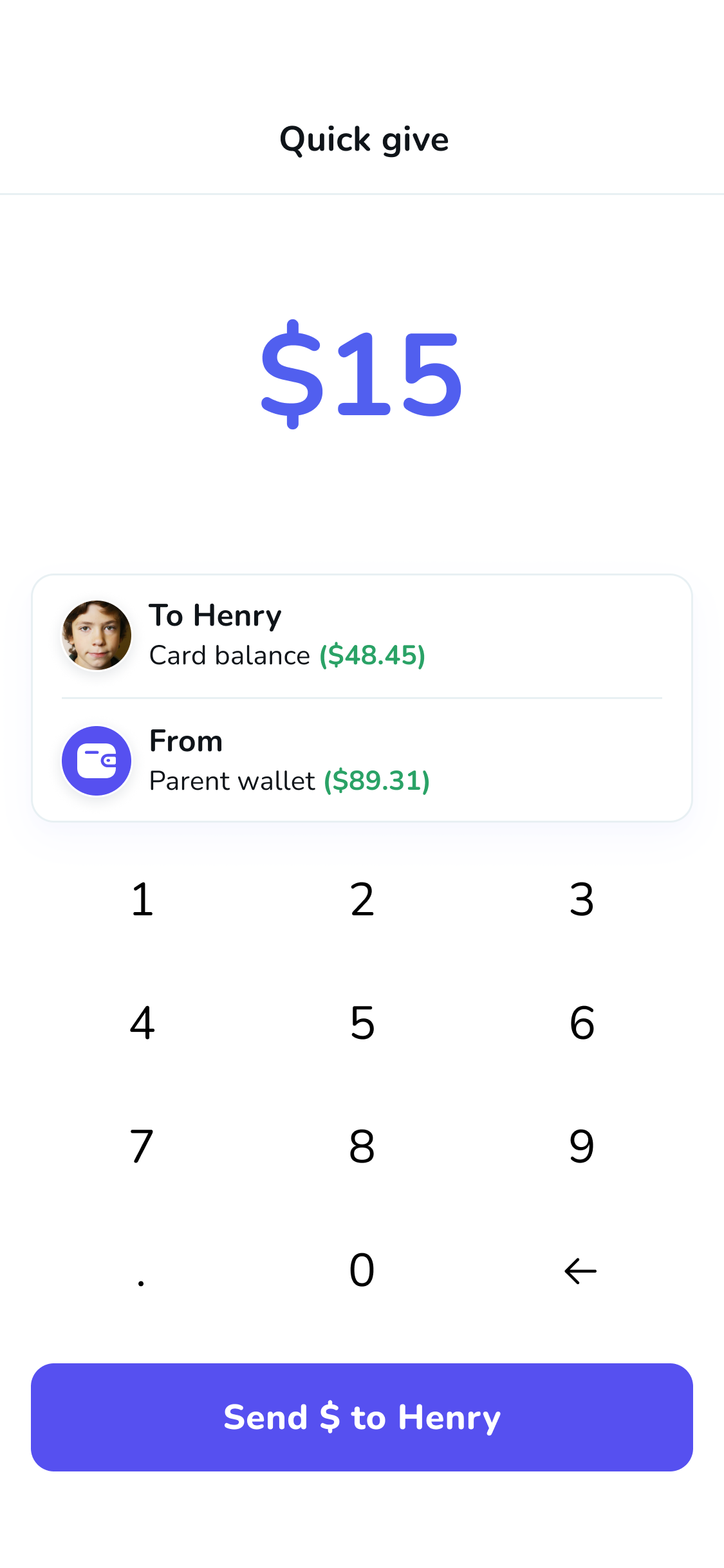

A real-world foundation, built on spending

It’s not all save, save, save. Till makes it so kids can learn how to manage money in real-life situations. With Till, kids and parents get concrete insights into spending behavior and see progress in real time.

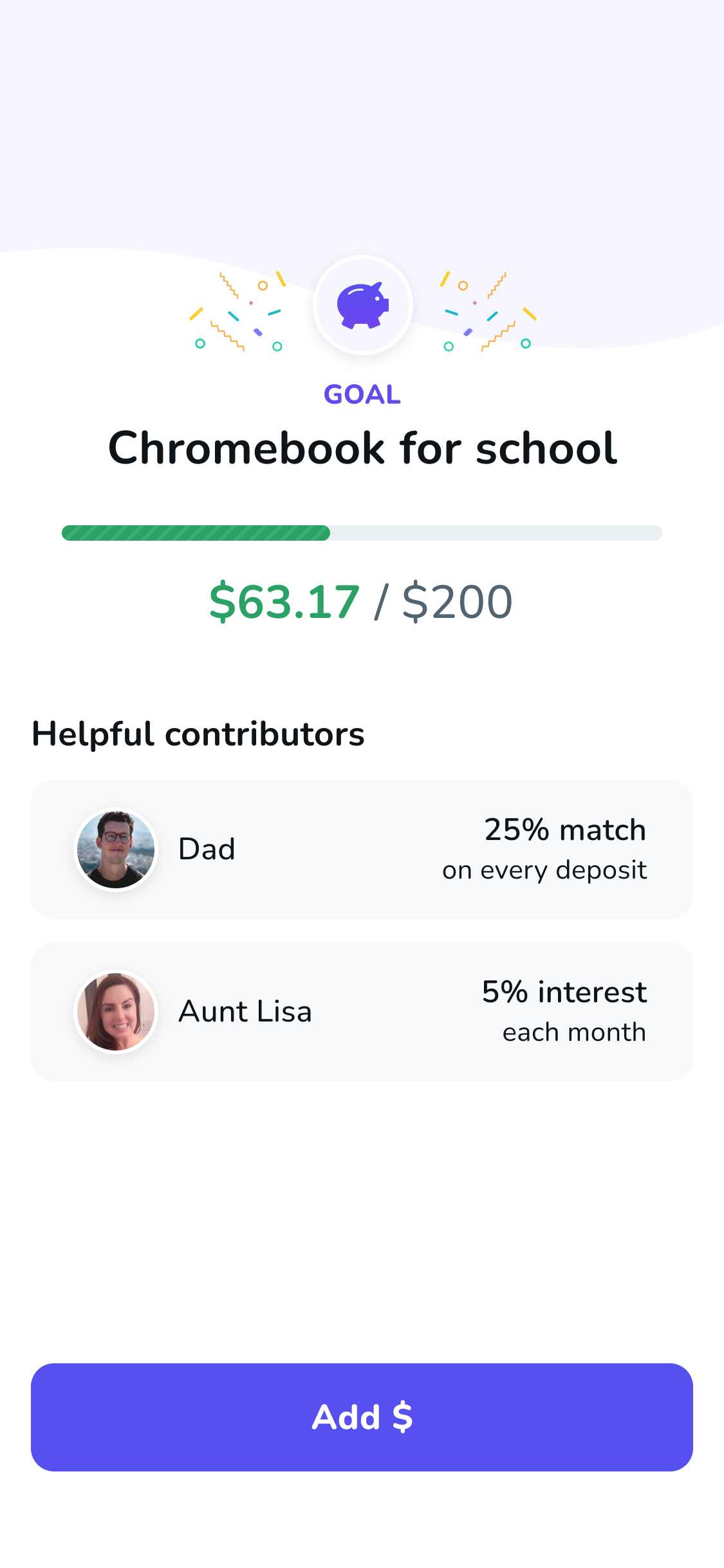

Set goals to save. See the progress

It’s about learning to make tradeoffs and saving while you spend. With Till, kids can set savings goals large and small—from video game consoles to their college fund.

Power-up kids’ earning

From everyday tasks to direct deposit from a part-time job, Till helps kids manage their earnings all in one place.

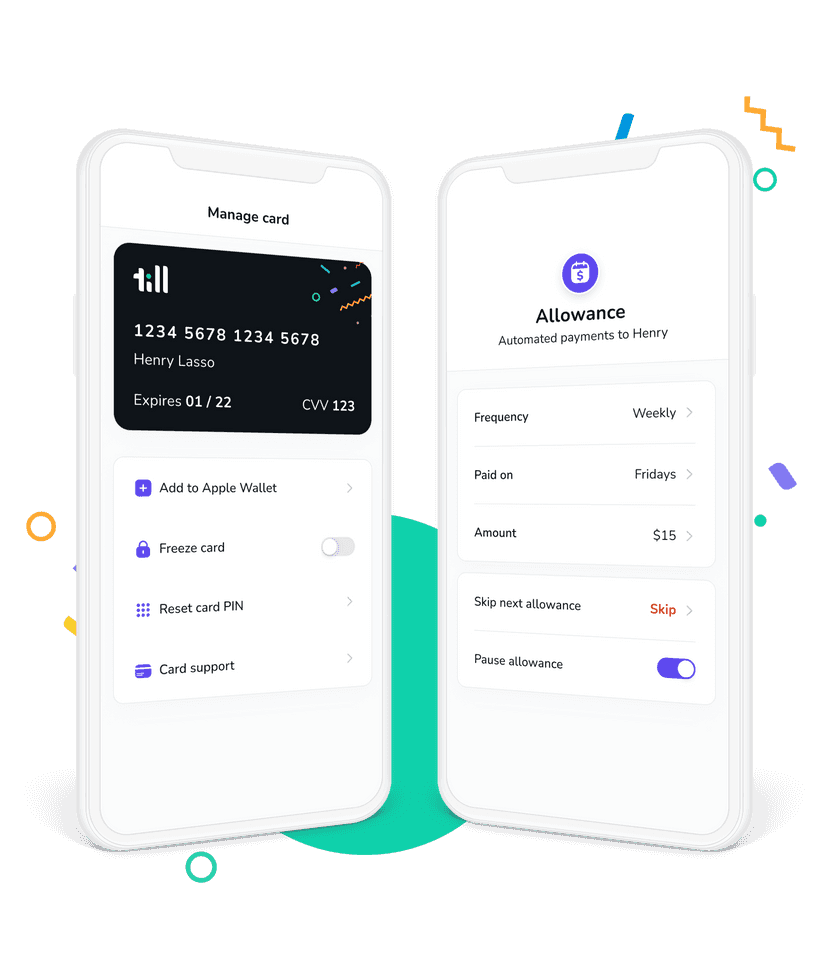

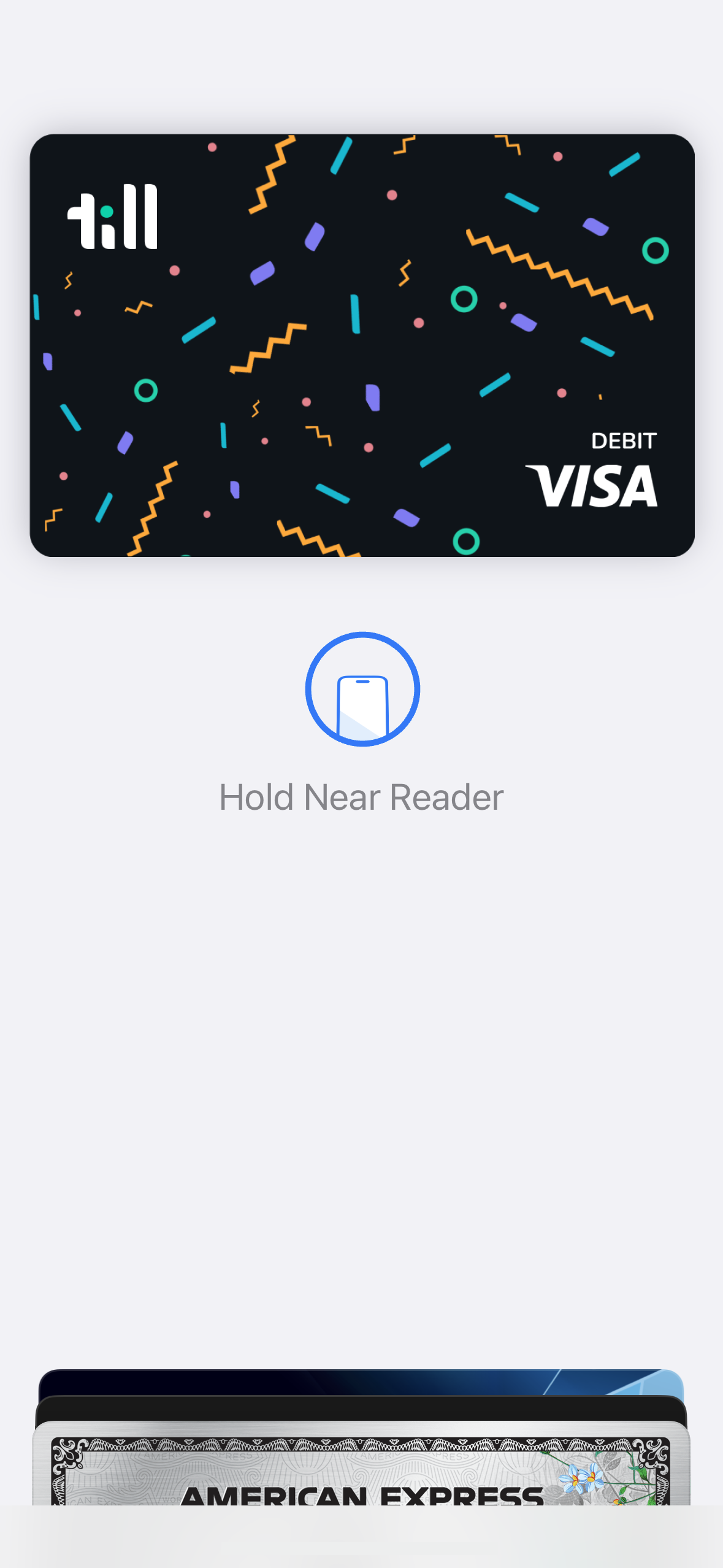

Spend securely

With a virtual and physical debit card kids are covered. No need to worry about losing cash, and if they misplace the physical card, you can freeze it with one tap.

"What's a Smarter Spender?" you may be wondering.

A young adult with the confidence to make informed, responsible decisions about money.

It’s a kid’s passport to the world of smarter spending.

The fee-free card, in tandem with our app, helps kids make real-life tradeoffs between spending and saving.

Scan this code with your phone’s camera to download Till.

The Till Effect

We’ve seen it time and again. When you treat kids with respect and put the decisions in their hands, they rise to the occasion. For countless Till users, we see the same results.

For Kids

The independence to spend on their own

The pride of “I bought it with my own money”

The security of not losing money. It’s safe in one spot.

For Parents

The pride of helping kids be more self-sufficient

Take the stress out of family conversations about money

Peace of mind from seeing their spending