Financial Education Curriculum for Group Leaders

Financial literacy curriculum delivered straight to your inbox for use in classrooms.

5 days of financial education

As a new benefit to group leaders courtesy of EF’s partnership with Till, we’re sharing a 5-day asynchronous curriculum series highlighting financial topics your students will encounter on their trip with EF Explore America. This curriculum is designed to build financial confidence in every student before, during, and after their trip. Curriculum created by our partners at FitMoney, an educational nonprofit providing financial literacy programs for grades K-12.

Financial Goal Setting

Understand the components of an actionable financial goal and explore common financial goals.

Budgeting & Everyday Savings

Compare savings strategies, create and evaluate a budget based on a planned savings goal. Evaluate decisions made while working towards a financial goal.

Budgeting & Smart Shopping

Given a budget, make spending decisions taking into account the price (unit price), personal priorities, influences and reliability of sources.

Comparing Payment Plans

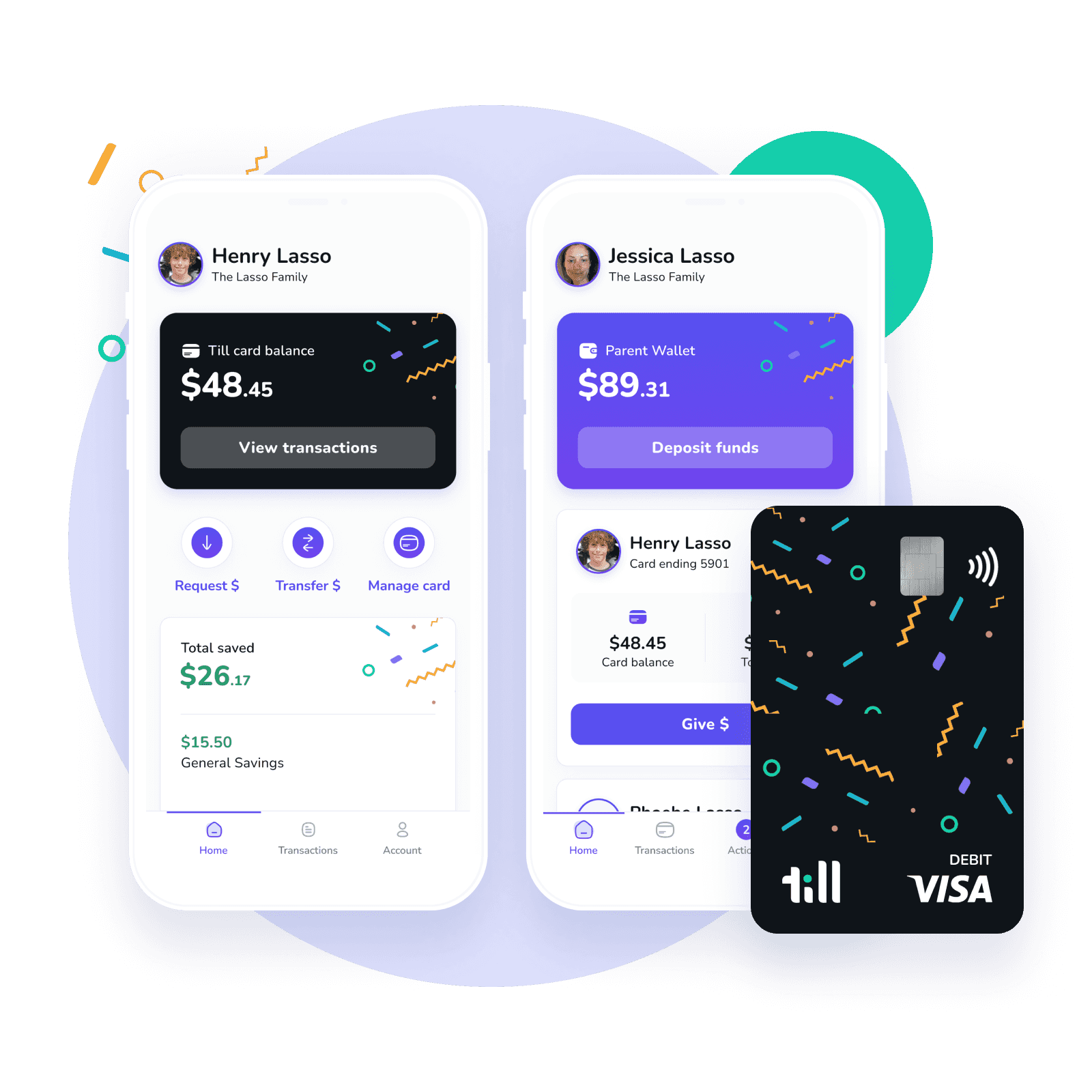

Explain how money transfers when using a certain payment type. Compare and contrast different payment types including: cash, debit cards, checks, prepaid debit/gift cards, payments apps, and credit cards.

Budget Building & Tracking

Break down their budget into more measurable parts and plan to track their spending to stay on budget.

Get the curriculum

Fill out the form below and the curriculum will be instantly sent to your email inbox.

Curriculum created by FitMoney.

Providing free, unbiased financial literacy programs to empower K-12 students with critical life skills for a financially fit future.

Continue your financial literacy journey with more resources from FitMoney, including our classroom-ready curriculum and online certificate program for at-home or classroom independent learning. Get started with a program right for you at fitmoney.org.